As college students across the US return to campus this fall, the staff and faculty who greet them should be equipped with new information: according to my analysis of first-of-its-kind data from the federal government, about 4 million of these students (23 per cent) will experience food insecurity, and 8 per cent will experience homelessness. Unless, of course, we do something to stop it.

Eating ramen and couch-surfing during college are popular tropes, reflecting a longstanding sense that temporary poverty is a suitable affliction – at least for some – while paying for school. But the real challenge is far more serious. Poverty is marring the critical college years for 35 per cent of African Americans, 30 per cent of Native Americans and 25 per cent of Hispanic students, pushing many out of school. Often in debt but without degrees, these former students aren’t experiencing higher education as a ticket to upward mobility, but rather an insidious betrayal of the promises of a better life through the vehicle of higher education.

Even students who seem immune to food insecurity – at least on paper, according to their Free Application for Federal Student Aid (FAFSA) and/or their high school academic records – are at risk. The federal data indicate that 18 per cent of students with a B average or better in high school, and 21 per cent of students whose full “demonstrated financial need” is met, experience food insecurity. These problems aren’t relegated to open-access community colleges or state universities; they also affect students at private doctoral-granting universities, some of the most gated in the country. Graduate students, international students, those attending historically black colleges and universities and especially students enrolled at taxpayer-supported for-profit colleges all deal with food insecurity and homelessness.

While educators and schools will never be able to end poverty for these students, and by no means should colleges and universities turn into social service agencies, there are many things that concerned faculty and staff can and should be doing. Even what seem like minor efforts are what Faye Allard, a community college professor, calls “little big things” that make students feel seen and valued.

For example, add a statement to the syllabus that acknowledges the reality of basic needs insecurity (in other words, that some students don’t have enough to eat or a safe place to sleep) and its impacts on learning, and that has information to help students find the necessary resources. Faculty at many institutions are finding this a useful way to ensure students know such “non-academic” factors matter and their professors want them to be OK. Going further with a welcome survey to help faculty better know their students, why they might be late to class or need extra support, can also convey that a professor cares, a strategy that science says pays off.

- The affirmative action ban is 'not an insurmountable setback' for higher education access

- Which specific Covid disruptions impacted motivation and engagement?

- Putting trust at the heart of higher education

Beyond the classroom, today’s college students need the sorts of supports provided to elementary and high school students who have financial difficulties. The National School Lunch Program provides those meals until students graduate from high school, and considering both the evident need and the evidence that feeding students promotes college graduation, it ought to be expanded to higher education. This allows students to count on eating meals on campus between classes and provides much more sustenance than mere food pantries offer.

Since the vast majority (84 per cent) of students live off-campus, they also need support with affording groceries. The Supplemental Nutrition Assistance Program (SNAP) is effective for adults (and children – one in five college students has a kid) but is designed in a way that makes it especially difficult for college students to obtain support. Those rules need to be changed so that people are rewarded, not penalised, for going to school. Also, colleges need to inform students about their eligibility for SNAP, lest they continue to go hungry without that knowledge.

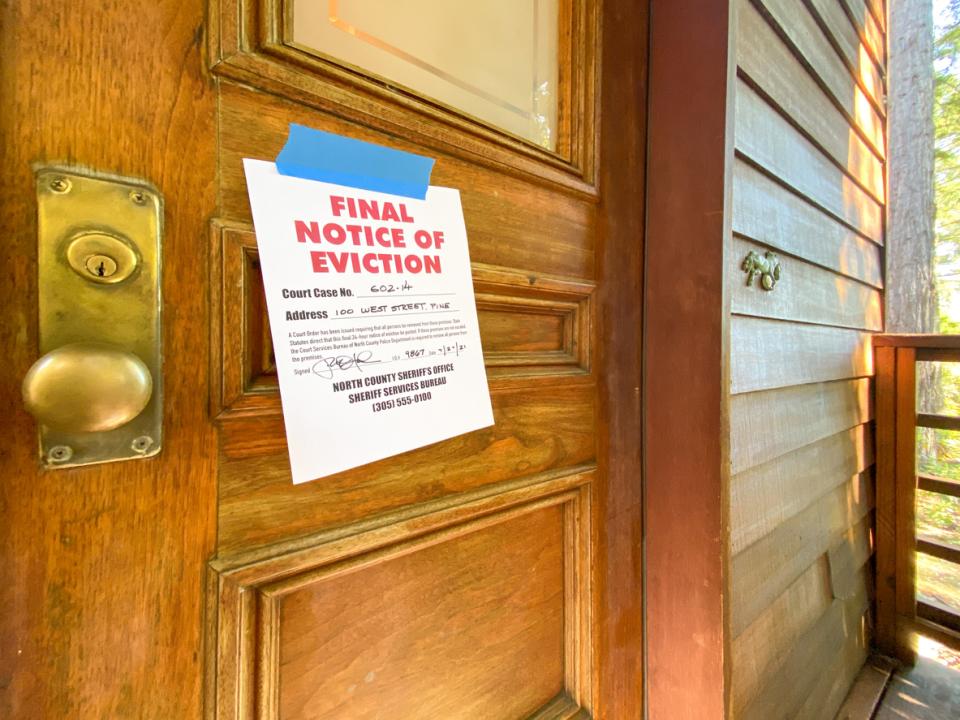

Rent and utilities are major costs that can add up fast and contribute to the risk of homelessness. Utility bills can be especially difficult to cover, as energy costs are unpredictable and heating costs rise in the winter, which begins just as financial aid for the fall term is running out. Requests for support paying for utilities are commonly received by campus emergency aid funds but could instead be handled by connecting students to the Low Income Home Energy Assistance Program and other community resources.

Another support available to help students, particularly in spring when their financial aid is running out, is the Earned Income Tax Credit (EITC). This is a refundable credit available to students who file taxes on their own; the value ranges from $600 for a single individual up to $6,600 (for a family with two children) or even more. Helping a student access those funds could eliminate their need for an emergency grant, enable them to afford to eat during final exams and/or allow them to register for summer courses. Many forward-thinking institutions share information about the EITC with their students and some even operate a voluntary income tax assistance site on campus to make filing easy and free. For students with children, connecting them to federal benefits like Temporary Assistance to Needy Families and the Child Care and Development Block Grant, while also ensuring that the institution participates in the Child Care Access Means Parents In School programme will help.

The current financial aid and college pricing system is so extensively broken, often communicating a misleading version of the real price of college, and that makes these efforts to go well beyond financial aid important. We should work to solve those structural problems while also improving service provision – including effective and equitable implementation – of public benefits access programmes, emergency aid and other support frameworks on college campuses. Our students can’t wait. Far too many of them are hungry to learn but are losing out on critical opportunities every single day.

Sara Goldrick-Rab is the author of Paying the Price: College Costs, Financial Aid, and the Betrayal of the American Dream, senior fellow at Education Northwest, and the founder of The Hope Center for College, Community, and Justice.

If you would like advice and insight from academics and university staff delivered direct to your inbox each week, sign up for the Campus newsletter.

comment1

(No subject)